Betting Against The Economy, why would Trump do that?

/

RSS Feed

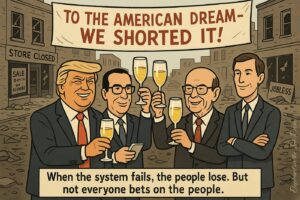

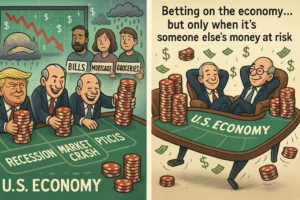

It’s one thing for ordinary investors to bet against the economy—it’s another when those in power do it. Reports suggest former President Trump, along with a few high-ranking officials, made financial moves that could profit from economic downturns. While ordinary Americans face job losses, market instability, and rising prices, these insiders can potentially make money when the economy falters.

This isn’t new. During the early days of COVID-19, several U.S. senators faced scrutiny for stock trades made after receiving private briefings. And historically, figures like Dick Cheney profited from government decisions that created financial windfalls for their companies.

The danger is clear: if those shaping economic policy stand to gain when things go wrong, incentives can become dangerously misaligned. Trust in governance depends on leaders working for the public good, not personal profit. Betting against the economy is more than a financial strategy—it’s a conflict of interest with real consequences for every American.

When leaders or high-ranking officials make financial moves that profit from economic decline, it undermines the very foundation of public trust. Reports suggest former President Trump and some government officials may have engaged in activities that allow them to benefit if the economy falters. These actions are troubling because while ordinary Americans face layoffs, inflation, and market volatility, insiders with privileged information can stand to gain.

This isn’t a new phenomenon. In 2020, during the early days of the COVID-19 pandemic, several U.S. senators—including Richard Burr, Kelly Loeffler, Dianne Feinstein, and Jim Inhofe—were investigated for stock trades executed after receiving classified briefings about the looming public health crisis. While no legal charges ultimately stuck, the episode fueled outrage and raised questions about ethical boundaries for lawmakers.

Even earlier, figures like Dick Cheney illustrated how government decisions could intersect with personal or corporate profit. Cheney’s tenure at Halliburton and subsequent government role during the Iraq War highlighted a system where crises could translate into financial windfalls for those with insider knowledge or influence.

Comments are Disabled