Politicization of Economic Data. When it sounds too good to be True, it Usually Is

/

RSS Feed

Firing of the Bureau of Labor Statistics Commissioner

On August 2, 2025, Trump abruptly dismissed Erika McEntarfer, commissioner of the Bureau of Labor Statistics (BLS), after a jobs report showing slow employment growth. He accused her of fabricating data without evidence—a claim widely condemned by economists and former officials who argue this politicization could seriously undermine faith in U.S. economic statistics and market stability. Experts warned such actions risk eroding credibility in one of the world’s most respected data agencies

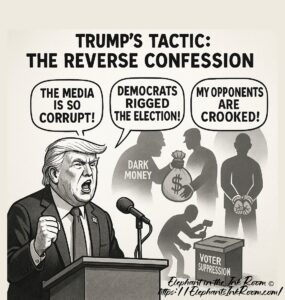

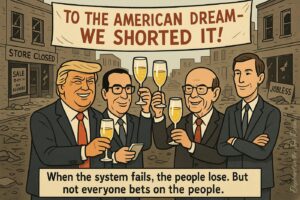

Below we get into more specific areas of how The Trump Administration is falseifing economic data. A feel good tactic for the Loyalist and a way to hide correct data for everyone else. Investing for our future and budgeting for today is impossible when the TRUTH is hidden, and the LIES are the only barometer we have to ‘depend’ upon.

1. Labor‐Market Statistics (BLS Reports)

What’s changing?

The BLS’s monthly employment and unemployment figures—long regarded as nonpartisan—are now subject to leadership appointments based on political loyalty rather than technical expertise. Surveys that underlie these reports already suffer from declining response rates (down from ~82% to 57.6%), increasing volatility and revisions in the headline numbers .

Threats:

Erosion of credibility in one of the world’s most trusted labor‐market gauges, which companies and policymakers rely on for hiring and rate‐setting decisions .

Heightened market volatility, as investors demand larger risk premiums to compensate for “flawed instrument panels” when interpreting jobs data .

2. Inflation Measurement (CPI & Producer Price Index)

What’s changing?

The BLS also compiles the Consumer Price Index and Producer Price Index—benchmarks for cost‐of‐living adjustments, Federal Reserve inflation targets, and Social Security benefits. Staffing cuts and budget shortfalls have already forced the BLS to scale back data collection, relying more heavily on statistical models rather than fresh survey information .

Threats:

Misleading inflation signals, which could delay or accelerate interest‐rate changes inappropriately, risking either unnecessary tightening (stoking recession) or easy money (fueling runaway prices).

Undermined public trust in price‐stability measures, potentially spurring “second‐order” effects like wage‐price spirals if workers and businesses doubt official CPI figures.

3. Federal Reserve Governance

What’s changing?

By publicly disparaging Fed Chair Jerome Powell and engineering board vacancies (e.g., the recent resignation of Governor Adriana Kugler), the administration is seeking a more “rate‐cut‐friendly” leadership team .

Threats:

Compromised central‐bank independence, which is crucial to anchoring inflation expectations. If markets believe the Fed must defer to political pressures, long-term borrowing costs rise and the U.S. dollar’s reserve‐currency status could weaken .

Comments are Disabled