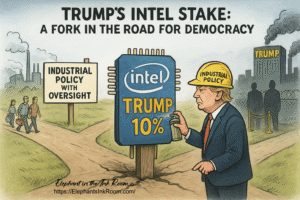

10% government stake in Intel – Good or Bad

1. What Trump Did

-

The administration reportedly secured a 10% government stake in Intel, and has intervened directly in markets.

-

This marks a shift from the Reagan-era conservative doctrine of deregulation, privatization, and “government out of the way.”

-

Instead, it leans toward industrial policy—the government actively picking winners and reshaping industries.

2. How It Changes Things

Potential Benefits

-

Strategic control: In critical sectors like semiconductors, government ownership could ensure national security and reduce reliance on foreign supply chains (esp. China).

-

Public leverage: A stake means taxpayers share in profits, not just subsidies. If Intel succeeds, the public could benefit directly.

-

Rapid mobilization: In crises (like war or supply chain breakdown), the government can direct resources more efficiently.

Potential Risks

-

Erosion of free-market discipline: When government owns part of a company, it can distort competition and reward political allies rather than the best performers.

-

Politicization of business: Decisions might be driven by electoral or partisan considerations, not long-term stability.

-

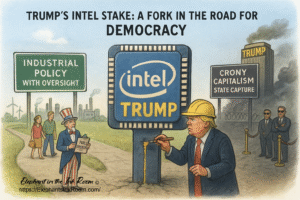

Crony capitalism: The line between legitimate national security intervention and favoritism for friends/donors becomes blurry.

3. Implications for Democracy

This is where it gets tricky:

-

Better for democracy (if done transparently):

-

If citizens see that government stakes mean accountability, profit-sharing, and national resilience, it could rebuild trust that democracy delivers.

-

Industrial policy, done openly, shows government is actively trying to protect workers, jobs, and sovereignty.

-

-

Worse for democracy (if done opaquely):

-

If Trump (or any leader) can direct state capital toward allies, donors, or politically useful industries, it becomes a tool of authoritarian-style control.

-

Concentrated power in the executive branch—deciding which companies thrive—weakens the role of Congress, markets, and watchdog institutions.

-

Citizens could lose faith that the economy is fair, seeing it instead as rigged by political power.

-

4. Historical Context

-

Reagan: Deregulation + belief in private sector efficiency.

-

FDR / WWII: Heavy government involvement in production—seen as necessary in an existential crisis.

-

China today: State-capitalist model—government directs investment, controls key industries, uses companies for geopolitical leverage.

Trump’s move edges the U.S. slightly toward the China model, away from the Reagan model.

5. The Democratic Bottom Line

-

If transparent and accountable → could strengthen democracy by showing government works for the people.

-

If secretive and politicized → could weaken democracy by concentrating power and blurring public/private interests.

So the real test isn’t just the Intel stake itself—it’s whether it’s managed with checks, balances, and public oversight, or whether it becomes another lever of personal power.

Trump’s Economic Shift: What It Means for Democracy

The Change

Trump is moving away from Reagan-era free-market conservatism by having the government take direct stakes in companies (Intel being the headline example) and intervening in markets.

Potentially Strengthens Democracy (Pro Case)

-

Shared Prosperity – If taxpayers hold equity, the public—not just private investors—benefits from profits.

-

National Security – Strategic industries (like semiconductors) stay resilient and less dependent on adversarial nations (esp. China).

-

Visible Action – Citizens see government actively solving problems, restoring some trust that democracy “delivers.”

-

Crisis Readiness – In moments of emergency, government stakes allow faster mobilization than free markets alone.

Analogy: FDR’s New Deal and WWII mobilization — heavy government involvement, but ultimately seen as strengthening democracy by protecting people and the nation.

Potentially Weakens Democracy (Con Case)

-

Politicized Economy – Leaders may favor allies, donors, or swing-state industries, eroding faith in fairness.

-

Crony Capitalism – Public stakes become a cover for funneling wealth or contracts to insiders.

-

Erosion of Checks & Balances – The executive, not Congress or independent regulators, ends up controlling major sectors of the economy.

-

Authoritarian Drift – Citizens may see government as a tool of one leader’s power rather than an impartial institution.

Analogy: China’s state-capitalist model — stability and strength for a time, but at the cost of transparency and individual freedom.

The Democratic Bottom Line

-

If transparent and accountable → this could look like a 21st-century New Deal: democracy showing it can adapt, protect, and deliver for its people.

-

If opaque and self-serving → this could be one more step toward government by strongman, where the economy is bent to political loyalty instead of public good

-

Here’s what public sources indicate regarding whether Donald Trump or his family personally hold any financial interest in Intel:

No Personal Financial Stake Reported

All credible reporting confirms that the 10% stake in Intel is held by the U.S. government, not any individual, including Trump or his family.

-

Financed through grants: The government converted roughly $11 billion from previously allocated CHIPS and Secure Enclave grants into a non-voting equity stake—approximately 9.9% to 10% of Intel.

-

Passive investment: The government’s ownership is described as passive—no board seats, no governance or information rights, and agreement to vote with Intel’s board in most cases.

-

Not Trump-family property: None of the reports mention any personal ownership by Trump or his family. The capital involved came strictly from federal funds, not private assets.

Financial Disclosure Context

-

Trump’s known investment profile: Public records and reporting show he has diversified holdings across multiple sectors (stocks, real estate, funds, etc.), including historical past holdings in companies like Intel. Yet, there is no indication that he or his family currently hold private Intel stock or a stake in this government-led deal.

-

The recent Intel stake is clearly portrayed as a federal government transaction, with no intermingling of Trump’s personal finances.

Summary Table

Entity Reports Indicate Stake? Notes Donald Trump (personal) No No evidence of ownership tied to this Intel stake Trump Family No No public disclosures connecting family to Intel equity U.S. Government (Trump administration) Yes 10% non-voting stake acquired from federal grants

Bottom Line

-

There is no public information or credible report showing that Trump or his family has any personal financial interest or greed in Intel related to this deal.

-

The 10% stake is strictly a federal government investment, backed by grants—not private funds.

.

-

Comments are Disabled